We can’t agree on spending" nearly broke us: How a family budget app brought us back together

Money fights were once the storm at the heart of our home. One of us wanted savings, the other craved comfort. A simple dinner decision could spiral into a heated exchange about priorities. We weren’t arguing about food—we were arguing about control, trust, and what kind of life we wanted for our family. But everything changed when we opened the same app on our phones. It wasn’t magic—it was clarity. With shared goals, real-time updates, and gentle nudges, we stopped blaming and started building. This is how a simple tool transformed not just our budget, but our marriage and family peace.

The Breaking Point: When Money Talk Turns into Family Tension

It started small—just a pair of shoes I bought without thinking, or a coffee subscription he didn’t realize was still active. But over time, these tiny oversights piled up like unread mail, each one adding weight to the silence between us. We weren’t fighting about money, not really. We were fighting about feeling heard, respected, and included in the decisions that shaped our family’s future. I remember one night, after the kids were in bed, a grocery receipt sparked a full-blown argument. $87. It wasn’t even that much, but to me, it felt like proof he wasn’t trying. To him, it was proof I didn’t trust him. We were both right—and both wrong.

What made it worse was how often the kids were around. I’ll never forget the look on my daughter’s face when she walked into the kitchen mid-argument. She didn’t say anything, just picked up her backpack and went to her room. That moment haunted me. We weren’t just hurting each other—we were unsettling our home. The tension didn’t disappear when the conversation ended. It lingered in the air, in the way we avoided eye contact at dinner, in the extra time one of us spent in the garage after work. Money wasn’t just numbers on a screen. It was emotion, history, fear, and love all tangled together.

And yet, we kept avoiding real conversations. We’d say things like, "We should talk about the budget," but never actually sit down. Or we’d start, and within minutes, someone would feel judged, and the door would close again. The silence grew louder than the arguments. We weren’t bad people. We weren’t irresponsible. We just didn’t have a way to see the same picture. One of us was saving for a rainy day; the other was trying to make today feel less gray. Without a shared view, every decision felt like a battle.

Why Traditional Budgeting Fails Busy Families

We tried the old ways, of course. I printed out a budget template and taped it to the fridge. For two weeks, I wrote down every coffee, every gas fill-up, every pack of gum. Then life happened. The kids got sick. Work got busy. I forgot to log half the things, and when I finally sat down to catch up, the numbers were already wrong. My husband tried a spreadsheet—one of those color-coded, formula-filled ones that looked impressive but took forever to update. He’d enter his expenses on Sunday, but by Wednesday, we were already out of sync. I’d buy school supplies, he’d refill the car, and neither of us remembered to tell the other. The spreadsheet became a source of guilt, not guidance.

The truth is, most families don’t fail because they’re bad with money. They fail because the tools they use don’t fit their lives. Pen and paper? Easy to lose. Spreadsheets? Time-consuming and lonely. A notebook in a drawer? Out of sight, out of mind. And let’s be honest—between school runs, meal prep, work deadlines, and keeping the laundry from piling up, who has the energy to track every dollar? We weren’t lazy. We were overwhelmed. And when one person carries the entire mental load of budgeting, resentment builds. "Why do I have to be the one who remembers?" becomes a quiet refrain, then a loud accusation.

Even when both partners try, traditional methods fall short because they lack real-time connection. You might think you’re under budget on dining out, only to find out your spouse just booked a family dinner at a nice restaurant. No malice—just misalignment. Without instant visibility, you’re both flying blind, making decisions based on old information. And when the credit card bill comes, the shock reignites the cycle of blame. The method wasn’t the problem. The disconnect was. We needed something that worked with our lives, not against them.

Enter the Family Budget App: A Shared Window into Your Money Life

The turning point came during a weekend walk. We were talking—really talking—for the first time in months. I mentioned how much easier my sister made budgeting look. She wasn’t stressed. She wasn’t hiding receipts. She just said, "We use an app. Everyone can see everything." That phrase stuck with me: everyone can see everything. No secrets. No surprises. Just clarity. We downloaded a family budget app that night. Not because we thought it would fix everything, but because we were tired of fighting.

What changed immediately was the transparency. For the first time, we were looking at the same numbers at the same time. When I bought groceries, he saw it instantly. When he filled the gas tank, I got a notification. No more "I didn’t know we were over budget on groceries." No more "You never told me about that subscription." The app didn’t judge us. It just showed us the truth. And that truth, as uncomfortable as it sometimes was, became the foundation of trust.

The app also gave us a way to set goals together. We picked one—just one—to start: a $2,000 emergency fund. We named it "Peace of Mind" and added a family photo. Every time one of us transferred money into it, we’d get a little celebration animation. Silly? Maybe. But it made saving feel like a team effort, not a sacrifice. We created categories that reflected our values: "Family Fun," "Home Upgrades," "Future Dreams." Suddenly, budgeting wasn’t about restriction. It was about intention. We weren’t cutting back—we were choosing what mattered.

And because the app synced automatically, we didn’t have to remember to update it. No more manual entry. No more guessing. It pulled in transactions from our bank accounts, credit cards, and even cash withdrawals (with a quick note). We could see spending trends over time, like how much we really spent on takeout or how often we impulse-bought online. The data wasn’t scary—it was empowering. For the first time, we weren’t reacting to money. We were leading it.

Getting Started: The 15-Minute Setup That Changes Everything

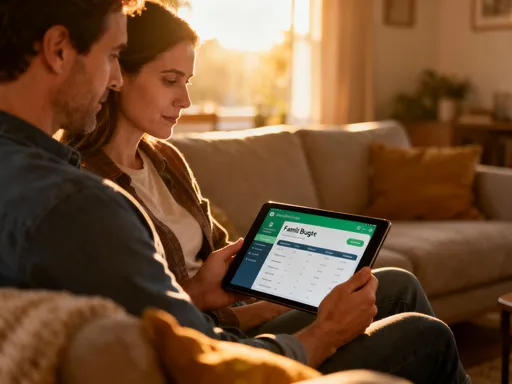

I’ll admit, I was nervous the first time we sat down to set it up. I thought it would take hours. I imagined passwords, spreadsheets, and complicated settings. But it wasn’t like that at all. We chose a quiet Sunday evening, after the kids were asleep. We grabbed our phones and a tablet so we could both see the screen. I made tea. He brought snacks. It felt more like a date than a chore.

The app walked us through it step by step. First, we picked which accounts to link—our checking, savings, and two credit cards. It took two clicks per account. Then we set up our shared goals. We started with the emergency fund, but we also added a "Family Weekend Trip" goal with a photo of the kids at the lake last summer. We laughed at how much they’ve grown. That small moment—connecting money to memory—made it real.

Next, we created categories that made sense for us. The app had defaults, but we customized them. We added "Kids’ Activities," "Date Night," and "Home Repairs." We even made one called "Surprise Joy" for those little things that make life brighter—a bouquet of flowers, a new book, a pie from the bakery. Giving our spending meaning made it easier to stick to.

The whole setup took less than 15 minutes. And the best part? We didn’t have to do it alone. The app sent my husband an invite, and he joined with one tap. From that moment, we were in it together. No more one person carrying the burden. No more "you handle the money." We were a team. That first night, we didn’t solve every financial problem. But we took a step—one small, shared step—toward something better.

Making It Stick: Building Habits the Whole Family Can Follow

The real magic didn’t happen on setup night. It happened in the weeks that followed. We committed to a weekly 10-minute check-in every Sunday morning. No laptops, no stress. Just us, coffee, and our phones. We’d open the app, review the week, celebrate wins, and adjust if needed. Did we go over on dining out? Instead of blame, we’d say, "Let’s plan more meals at home next week." Did we save more than expected? We’d cheer and move a little extra to our vacation fund.

We also started including the kids—age-appropriately. Our 10-year-old daughter loves checking the "Family Trip" goal. She’ll say, "Mom, we’re only $150 away!" and it makes her proud to help—whether it’s picking a movie night instead of going out or saving her allowance. Our son, who’s 7, draws pictures for our "Home Upgrades" goal. He calls it his "house art fund." Including them didn’t make them little accountants. It made them part of the story. They learned that waiting can be worth it. That teamwork brings rewards. That money isn’t just for spending—it’s for building.

We also stopped fearing notifications. At first, every alert felt like a scolding. "You’ve spent 80% of your grocery budget." But over time, we realized they were just information—like a weather alert. "It might rain, so bring an umbrella." The app didn’t shame us. It supported us. We turned off the loud alerts and chose gentle ones. "You’re on track!" "Great job this week!" Those small affirmations made a difference.

And when life threw curveballs—a car repair, a medical bill—we didn’t panic. We opened the app, adjusted our goals, and made a plan. The flexibility kept us from giving up. Budgeting wasn’t a rigid rulebook. It was a living system that moved with us. Over time, checking the app became as natural as checking the weather. It wasn’t a chore. It was care.

Beyond Budgeting: How Shared Finances Strengthen Family Bonds

What surprised us most wasn’t the savings. It was the shift in how we related to each other. The arguments didn’t just decrease—they changed. Instead of "You spent how much?" we started saying "How can we make this work?" Money stopped being a weapon and became a conversation starter. We talked about dreams, fears, and what kind of life we wanted. We discovered we both wanted more family time. We both worried about the future. We just hadn’t had a safe space to say it.

The app created that space. Because the numbers were neutral, we could talk about them without defensiveness. We started planning together—what to save for, when to splurge, how to handle unexpected costs. We made decisions as partners, not opponents. And that partnership bled into other parts of our relationship. We communicated better. We listened more. We felt more connected.

Our kids noticed it too. They didn’t hear yelling about money anymore. They saw us high-fiving over a goal reached. They heard us say, "We did it!" as a family. That sense of unity became part of our home’s rhythm. We weren’t just managing money. We were modeling values—responsibility, patience, teamwork, and hope. Those are lessons no textbook can teach.

One night, as we were tucking the kids in, our daughter said, "I like when we talk about our goals. It makes me feel like we’re all in it together." That’s when it hit me. The app wasn’t just about dollars and cents. It was about us. It gave us a shared language, a common purpose, and a way to show up for each other every day.

A Calmer, Clearer Home: What Life Looks Like When You’re on the Same Page

Today, our home feels different. Lighter. Kinder. We still have expenses. We still make mistakes. But we don’t carry the weight alone. When one of us overspends, the other doesn’t react with anger. We look at the app, talk it through, and adjust. There’s grace now. There’s understanding. And there’s a deep sense of peace that comes from knowing we’re moving in the same direction.

We’ve saved for a new roof, a summer camp for the kids, and even a short vacation. But more than that, we’ve saved our connection. We’ve rebuilt trust. We’ve created a home where money isn’t a source of fear, but a tool for love. The app didn’t fix our marriage. It gave us a way to fix it ourselves.

I won’t pretend it’s perfect. Some weeks are harder than others. But now we have a system—a shared rhythm—that helps us stay aligned. We check in. We adjust. We celebrate. And we keep going.

If you’re in a place where money feels like a wall between you and your partner, I want you to know there’s another way. It starts with one conversation. One app. One shared goal. It’s not about being rich. It’s about being together. It’s about looking at the same screen and saying, "This is ours. Let’s build it together."

Because peace isn’t found in a perfect budget. It’s found in a shared vision. And that’s something worth investing in.