How I Protect My Gains Without Losing Sleep—A Real Investor’s Playbook

What if you could grow your investments without constantly worrying about losing everything? I’ve been there—chasing returns only to watch them vanish overnight. Over time, I learned that preserving what you’ve earned matters just as much as making it. This isn’t about get-rich-quick schemes. It’s about staying safe, staying smart, and building lasting value. Let me walk you through the strategies that helped me protect my portfolio while still earning solid returns—no hype, just real talk.

The Hidden Risk Everyone Ignores

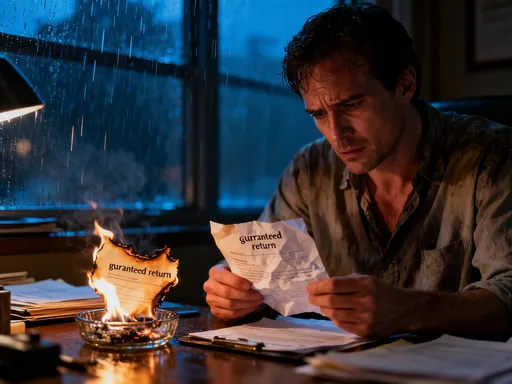

Many investors focus solely on growth, but chasing high returns can expose you to hidden dangers. Market swings, emotional decisions, and overconcentration in one asset can wipe out years of progress overnight. I once doubled down on a 'hot' sector, only to lose nearly half my gains when it crashed. That wake-up call taught me that risk control is not optional—it’s essential. Understanding what threatens your portfolio is the first step toward protecting it. This section explores common pitfalls that erode investment returns and why asset preservation must be built into every strategy from day one.

One of the most underestimated threats is emotional investing. When markets rise, excitement builds, and people pour money into assets that have already gone up, often ignoring fundamentals. When prices fall, fear takes over, and many sell low—locking in losses. This behavior turns volatility into permanent damage. The solution isn’t willpower alone; it’s structure. A well-designed investment plan includes built-in mechanisms to reduce emotional interference. For example, setting predetermined entry and exit points removes the need to react in the moment. These rules don’t guarantee profits, but they do prevent costly mistakes driven by panic or greed.

Another hidden risk is overexposure to a single asset class, sector, or even geographic region. When I first started investing, I believed I was diversified because I owned multiple stocks. But when the tech sector took a hit, my entire portfolio suffered—even though I had five different holdings, they were all tied to the same industry. True diversification requires more than just quantity; it demands variety in how investments respond to economic events. For instance, bonds often rise when stocks fall, and real estate can hold value during inflationary periods. Recognizing these dynamics allows investors to build portfolios that don’t move in lockstep, reducing overall risk.

Additionally, many overlook the impact of fees and taxes on long-term returns. High expense ratios, frequent trading, and poor tax planning can silently eat away at gains. A fund charging 1.5% annually may seem modest, but over 20 years, it can reduce final wealth by tens of thousands of dollars compared to a low-cost alternative. Similarly, selling assets without considering capital gains can trigger unnecessary tax liabilities. These factors don’t make headlines, but they shape outcomes. That’s why reviewing account structures, choosing tax-efficient vehicles like IRAs or 401(k)s, and opting for low-cost index funds are critical steps in any risk-aware strategy.

Why Gains Mean Nothing Without Protection

Earning returns feels great—until you lose them. I celebrated a 20% gain one year, only to lose it all the next because I didn’t lock in profits or adjust my risk. Real wealth isn’t built by peaks; it’s built by keeping what you make. That shift in mindset—from just growing to actively shielding—changed everything for me. Here, we’ll examine why sustainable returns depend on preservation, how volatility impacts long-term results, and the psychological comfort that comes from knowing your assets are guarded.

Volatility isn’t just noise—it directly affects compound growth. Consider two investors: one earns 10% each year consistently, while the other alternates between +30% and -10%. Both average 10%, but the first ends up with significantly more money after a decade due to smoother compounding. This is known as the volatility tax—the idea that large swings reduce long-term wealth even if average returns look the same. Protecting against drawdowns isn’t about avoiding risk entirely; it’s about managing it so that recoveries don’t require outsized gains just to get back to even.

Preservation also plays a crucial role in behavioral finance. When portfolios suffer sharp declines, investors are more likely to abandon their plans. Studies show that many individuals sell near market bottoms, often after enduring prolonged stress. By contrast, those with protected portfolios—through diversification, cash reserves, or hedging strategies—are more likely to stay the course. This consistency is what separates successful long-term investors from those who chase performance. Knowing your downside is limited allows you to remain calm during turbulence, which in turn leads to better decision-making.

Another key aspect of protection is profit-taking. Too often, investors let winners run indefinitely, assuming the trend will continue. But markets don’t go up forever. Establishing rules for trimming positions when they become overvalued helps secure gains and reallocate capital to undervalued areas. For example, if a stock doubles in value and now represents a much larger share of your portfolio than intended, selling part of it brings your allocation back in line. This isn’t pessimism—it’s discipline. It ensures that past winners don’t turn into future anchors, dragging down overall performance.

Diversification Done Right (Not Just Spreading Money Around)

Putting money in different places isn’t enough. I used to think owning five stocks across two sectors was diversified—until both sectors tanked together. True diversification means balancing assets that react differently to market events. This section breaks down how to build a resilient mix of investments, including how non-correlated assets can reduce risk without sacrificing returns. You’ll learn how to assess your current holdings and rebalance them for better protection.

Effective diversification goes beyond simply owning multiple stocks or funds. It involves combining asset classes with low correlation—meaning they don’t move in tandem. For instance, when equities fall during a recession, high-quality bonds often rise as investors seek safety. Real estate investment trusts (REITs) may perform well during inflation, while commodities like gold can act as hedges against currency devaluation. By including such assets, a portfolio can maintain stability even when one segment struggles.

Geographic diversification is another powerful tool. U.S. markets don’t always lead global performance. In some years, emerging markets or developed economies in Europe or Asia outperform. Allocating a portion of your portfolio internationally reduces dependence on any single country’s economic health. Exchange-traded funds (ETFs) focused on international indexes offer an accessible way to gain exposure without picking individual foreign stocks. However, it’s important to avoid overcomplicating—too many small positions can dilute returns and increase management burden.

One common mistake is assuming all stock diversification is equal. Owning multiple tech companies still leaves you exposed to sector-specific risks. Instead, consider spreading across market capitalizations—large-cap, mid-cap, and small-cap stocks—since they often perform differently under various economic conditions. Small caps may grow faster in expansions, while large caps tend to be more stable during downturns. Similarly, value stocks (undervalued relative to earnings) and growth stocks (expected to grow rapidly) behave differently across market cycles. A balanced mix improves resilience.

The Power of Rebalancing: Staying on Track Automatically

Markets move, and so should your strategy. I set up automatic rebalancing after ignoring my portfolio for months—only to find it dangerously skewed. Rebalancing isn’t about timing the market; it’s about maintaining your intended risk level. We’ll walk through how regular adjustments help you sell high, buy low, and keep your portfolio aligned with your goals—without emotional interference.

Over time, some investments outperform others, causing your original asset allocation to drift. For example, if stocks rise sharply, they may grow from 60% of your portfolio to 75%, increasing your exposure to market risk. Rebalancing brings it back to your target—say, selling some stocks and buying bonds. This forces you to take profits from winners and reinvest in underperforming assets, which may be undervalued. In essence, it institutionalizes the principle of buying low and selling high, without requiring market predictions.

There are two main approaches: calendar-based and threshold-based rebalancing. Calendar-based means adjusting at regular intervals—annually or semi-annually—regardless of market moves. This method is simple and prevents overtrading. Threshold-based rebalancing triggers action only when an asset class deviates significantly from its target—say, by 5% or more. This responds to actual changes rather than arbitrary dates but may lead to more frequent trades in volatile periods. Many investors combine both: reviewing annually and adjusting only if thresholds are breached.

Automation makes this process easier and more reliable. Many brokerage platforms offer automated rebalancing tools that monitor allocations and execute trades when needed. This removes the temptation to delay or skip rebalancing due to busyness or emotion. It also ensures consistency, which is vital for long-term success. While rebalancing may trigger minor tax consequences in taxable accounts, the benefits of risk control usually outweigh the costs, especially when done in tax-advantaged accounts like IRAs.

Cash Isn’t Dead—It’s a Secret Weapon

Holding cash often feels like 'doing nothing,' but I’ve learned it’s one of the most powerful tools in volatile times. After a major correction, having dry powder let me buy strong assets at discounts. This section explains how strategic cash reserves provide flexibility, reduce panic selling, and act as a shock absorber when markets turn.

Cash serves multiple purposes beyond just safety. First, it provides liquidity for unexpected expenses, preventing the need to sell investments at inopportune times. Second, it enables opportunistic buying when markets dip. During the 2020 market drop, investors with cash were able to purchase quality stocks at depressed prices, leading to strong rebounds in subsequent months. Those who were fully invested had no room to take advantage.

The right amount of cash depends on individual circumstances, including income stability, time horizon, and risk tolerance. A common guideline is to keep three to six months of living expenses in liquid accounts. For investors, an additional 5% to 10% of the portfolio in cash or cash equivalents can serve as a tactical reserve. This isn’t idle money—it’s strategic capital ready to deploy when conditions are favorable.

Some worry that holding cash means missing out on gains. While it’s true that cash earns little in low-interest environments, its value lies in optionality. The ability to act when others are forced to react is a significant advantage. Moreover, short-term instruments like money market funds or Treasury bills offer modest returns with minimal risk, making them better than standard savings accounts for this purpose. The goal isn’t to maximize yield on cash but to preserve capital and maintain flexibility.

Stop-Losses and Safety Nets: Smart Traps vs. False Security

Stop-loss orders sound foolproof—until they trigger during a short dip and lock in losses. I tested several approaches and found that rigid rules can backfire. Instead, I now use conditional exits and trailing buffers that protect me without overreacting. Here, we’ll explore practical ways to set intelligent exit strategies that balance discipline with flexibility.

A traditional stop-loss order automatically sells a stock when it drops a set percentage, say 10%. While this limits downside, it doesn’t distinguish between temporary volatility and a true trend reversal. In fast-moving markets, prices can gap down, triggering the sale far below the stop price. Worse, short-term swings can activate the stop, only for the stock to rebound immediately—leaving you out of a recovery.

A better approach is the trailing stop, which adjusts upward as the stock price rises. For example, a 15% trailing stop follows the peak price, locking in gains while allowing room for normal fluctuations. This way, if the stock climbs 30%, the floor moves up with it. Only a sustained drop triggers a sale. This method aligns with the principle of cutting losses short and letting winners run, but with built-in adaptability.

Another strategy is using time-based or fundamental triggers. Rather than relying solely on price, you might decide to exit if a company’s earnings deteriorate, debt increases, or management changes. These signals reflect underlying health rather than market noise. Combining price-based and fundamental criteria creates a more robust safety net. For instance, you might hold through a 10% dip if fundamentals remain strong, but sell if both price and earnings decline.

Building a Long-Term Mindset: The Ultimate Shield

The best protection isn’t a tool—it’s your mindset. When I stopped checking prices daily and focused on long-term fundamentals, my decisions improved dramatically. Emotional reactions vanish when you have a clear plan. This final section covers how patience, consistency, and process-oriented thinking turn volatility into opportunity, making your portfolio not just safer, but stronger over time.

A long-term perspective reduces the impact of short-term noise. Market commentary, news headlines, and quarterly results create a constant stream of distractions. But for investors with a 10- or 20-year horizon, these fluctuations are temporary. Companies with strong business models, consistent cash flow, and competent leadership tend to reward patient owners. By focusing on these qualities rather than price movements, you align your strategy with reality rather than emotion.

Consistency is equally important. Regular contributions to retirement accounts, steady rebalancing, and ongoing education compound over time. Just as compound interest grows wealth, compound discipline grows confidence. You don’t need perfect timing—just persistent action. Dollar-cost averaging, for example, involves investing a fixed amount regularly, buying more shares when prices are low and fewer when high. Over time, this smooths out entry points and reduces the risk of poor timing.

Finally, process over outcomes fosters resilience. Instead of measuring success by annual returns, evaluate your adherence to the plan. Did you rebalance? Did you avoid panic selling? Did you stick to your allocation? These behaviors matter more than any single year’s performance. A good process won’t prevent losses entirely, but it will ensure they’re manageable and part of a broader strategy. Over decades, this approach leads to durable wealth and peace of mind.

Preserving assets isn’t about playing defense—it’s about playing smart. By combining strategic diversification, disciplined rebalancing, and emotional control, you create a foundation where gains can grow and survive. I wish I’d learned this earlier, but the good news is: it’s never too late to start protecting what you’ve worked so hard to build.