How I Stopped Putting All My Eggs in One Basket — A Real Fund Manager’s Take on Smarter Asset Diversification

What if the biggest risk to your portfolio isn’t the market—but your own choices? I learned this the hard way after watching part of my fund dip unexpectedly. That moment pushed me to rethink everything. Asset diversification isn’t just a buzzword; it’s a survival tool. In this guide, I’ll walk you through how spreading investments strategically can protect and grow wealth over time—without relying on luck or hype. This is not about chasing trends or betting on the next big thing. It’s about building resilience, reducing avoidable risks, and creating a structure that works whether markets rise, fall, or stay flat. The goal isn’t perfection—it’s sustainability.

The Wake-Up Call: When Concentration Backfires

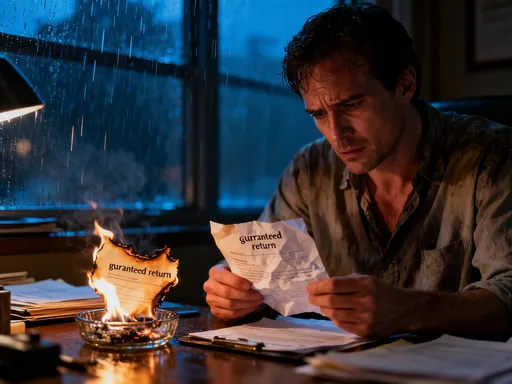

It started with confidence—too much of it. Like many fund managers early in their careers, I believed that deep expertise in a single sector gave me an edge. My fund was heavily weighted in technology stocks, a space I knew well and had followed for years. The returns were strong, even stellar, for two consecutive years. Clients were happy, performance reports looked impressive, and I began to believe the strategy was bulletproof. But then, without warning, a shift occurred. Regulatory scrutiny increased, growth projections softened, and sentiment turned. Within six months, the segment I relied on most lost nearly 30% of its value. The impact on the overall portfolio was immediate and painful.

That experience was a wake-up call. I had underestimated concentration risk—the danger of overexposure to a single asset class, industry, or region. It’s not just a theoretical concern; it’s a real and present threat that can strike even the most informed investors. What made it worse was that the decline wasn’t due to poor company performance across the board, but to systemic forces beyond individual control. Market cycles shift, regulations evolve, and consumer behavior changes—none of which can be perfectly predicted. Yet, by anchoring so much of the portfolio to one area, I had left no buffer when the tide turned.

The emotional toll was just as significant as the financial one. Watching years of compounded gains erode in months shook my confidence. Clients began asking harder questions, and I struggled to explain why a strategy that had worked so well suddenly failed. The truth was uncomfortable: I had confused past performance with future certainty. That period taught me that confidence without contingency is dangerous in finance. Diversification isn’t about doubting your choices—it’s about respecting uncertainty. When one part of your portfolio stumbles, others can hold steady or even rise, softening the blow and preserving capital for recovery.

What Asset Diversification Really Means (And What It Doesn’t)

Many investors believe they’re diversified simply because they own multiple funds or stocks. But true diversification goes deeper than quantity. It’s not about how many assets you hold, but how those assets behave in relation to one another. The core idea is to combine investments that do not move in lockstep—assets that are uncorrelated or, ideally, negatively correlated—so that when one declines, another may remain stable or increase. This reduces overall volatility and improves the risk-adjusted return of the portfolio.

For example, holding ten different technology stocks across the U.S. may feel like diversification, but if they all respond similarly to interest rate changes or regulatory news, they are still highly correlated. Real diversification means looking beyond sector and geography. It includes balancing equities with fixed income, incorporating real assets like real estate or commodities, and considering alternative investments such as private credit or infrastructure funds. These categories often react differently to economic shifts, providing a more stable foundation.

Another common misconception is that diversification guarantees higher returns. It doesn’t. Its primary role is risk mitigation, not performance enhancement. You may not capture the full upside of a booming sector, but you also avoid the full downside when it corrects. Over time, this smoother ride leads to more consistent compounding. Studies have shown that portfolios with moderate diversification often outperform concentrated ones over long periods, not because they rise faster, but because they fall less during downturns.

Equally important is understanding what diversification does not do. It cannot eliminate all risk—market risk, inflation risk, and liquidity risk still exist. Nor does it protect against poor investment selection. Owning a mix of overvalued assets won’t save you from losses. Diversification works best when combined with disciplined valuation analysis and a long-term perspective. It’s a structural safeguard, not a magic shield. When used correctly, it allows investors to stay the course during turbulence, avoiding the costly mistake of selling low out of fear.

Why Markets Demand Smart Spreading—Not Just Luck

Markets are inherently unpredictable. No one can consistently time peaks and troughs, and relying on luck is not a strategy—it’s a gamble. What history shows, however, is that different asset classes perform well under different economic conditions. Equities tend to thrive in periods of growth and low inflation, while bonds often stabilize portfolios during recessions. Real estate can hedge against inflation, and commodities may gain when supply constraints emerge. By spreading exposure across these categories, investors position themselves to benefit from various scenarios rather than bet on a single outcome.

Consider the global financial crisis of 2008. Stock markets plunged, but high-quality government bonds delivered positive returns as investors sought safety. A portfolio concentrated in equities would have suffered severe losses, while one balanced with fixed income saw much smaller declines. Similarly, during the inflation surge of the early 2020s, traditional stocks and bonds both struggled—a rare occurrence known as a “risk-off” environment. Yet, assets like gold, energy stocks, and inflation-linked bonds held up better. These examples illustrate why relying on any one asset class is inherently risky.

Market cycles are also longer than many realize. Bull markets can last years, lulling investors into complacency. But corrections and bear markets are inevitable. The S&P 500 has experienced double-digit declines roughly once every six years since 1950. While recoveries usually follow, the timing is uncertain. Diversification helps investors endure these periods without abandoning their strategy. It creates psychological resilience as much as financial stability—knowing that not everything is at risk at once makes it easier to stay invested.

Moreover, global interconnectedness means that shocks in one region can ripple across markets. Geopolitical tensions, supply chain disruptions, or currency fluctuations can impact even well-chosen stocks. A geographically diversified portfolio—holding assets across developed and emerging markets—can reduce dependence on any single economy. This doesn’t mean equal allocation everywhere, but rather thoughtful exposure based on economic fundamentals and growth potential. Smart spreading isn’t about chasing every opportunity; it’s about building a portfolio that can adapt as conditions change.

Building Your Diversification Framework: A Step-by-Step Approach

Creating a diversified portfolio isn’t a one-time task—it’s an ongoing process grounded in clear goals, realistic risk assessment, and disciplined execution. The first step is defining your investment objectives. Are you saving for retirement, funding education, or building long-term wealth? Each goal has a different time horizon and risk tolerance. A 40-year-old planning for retirement can afford more volatility than someone nearing withdrawal age. Clarifying these priorities shapes the entire structure.

Next comes risk assessment. This isn’t just about how much loss you can tolerate emotionally, but how much your financial plan can withstand without derailing. Tools like risk tolerance questionnaires can help, but real insight comes from reviewing past behavior during market stress. Did you sell during the 2020 pandemic dip? Or did you hold or buy more? Understanding your true risk profile prevents overcommitting to aggressive strategies during calm periods, only to abandon them when volatility returns.

With goals and risk level established, the next phase is asset allocation. This is the backbone of diversification. A common starting point is the traditional 60/40 split—60% equities, 40% bonds—but this isn’t universal. Younger investors might lean toward 80/20, while those nearing retirement may shift to 40/60. The key is alignment with objectives and risk capacity. Within equities, further diversification is essential: blending large-cap, mid-cap, and small-cap stocks; mixing growth and value styles; and including both domestic and international exposure.

Fixed income should also be diversified—not just in terms of issuer (government, corporate, municipal) but duration and credit quality. Short-term bonds behave differently than long-term ones, especially when interest rates change. Alternatives, while not suitable for everyone, can add another layer of balance. Real estate investment trusts (REITs), infrastructure funds, or managed futures may offer returns uncorrelated with traditional markets. The process isn’t about complexity, but completeness. Regular rebalancing—typically once a year or when allocations drift more than 5% from target—ensures the portfolio stays on course without emotional decision-making.

Hidden Pitfalls That Undermine Diversification Efforts

Even with the best intentions, diversification can fail due to subtle but critical errors. One of the most common is the illusion of diversification. For instance, owning multiple mutual funds that all track the same index or focus on similar sectors gives a false sense of security. If all funds are tied to U.S. large-cap tech stocks, a downturn in that space will affect everything simultaneously. True diversification requires examining underlying holdings, not just fund names.

Another pitfall is currency risk. Investing in foreign equities without hedging currency exposure can introduce volatility unrelated to company performance. A European stock might rise in local currency, but if the euro weakens against the dollar, the U.S. investor sees little or no gain. This hidden factor can erode returns over time, especially in emerging markets where currency swings are more pronounced. Awareness of this risk allows for better planning—whether through hedged funds or strategic allocation limits.

Behavioral biases also play a destructive role. Familiarity bias leads investors to favor what they know—U.S. stocks, their employer’s stock, or local real estate—limiting global exposure. Herd mentality pushes people into popular sectors at the peak of their cycle, like chasing cryptocurrency or AI stocks in a speculative frenzy. These tendencies undermine diversification by concentrating risk where it’s least needed. Recognizing these patterns is the first step to countering them.

Tax considerations can also distort decisions. Investors may avoid selling appreciated assets to prevent capital gains taxes, even when rebalancing is necessary. This leads to overconcentration and increased risk. Using tax-advantaged accounts or timing sales strategically can help maintain balance without unnecessary tax burdens. The goal is to let strategy, not emotion or tax fear, drive decisions.

Tools and Indicators That Help You Stay on Track

Maintaining a diversified portfolio requires more than good intentions—it demands regular monitoring and informed decision-making. One of the most useful tools is the correlation matrix, which shows how different assets move in relation to each other. A correlation of 1.0 means two assets move perfectly together, while -1.0 means they move in opposite directions. Most portfolios benefit from holdings with low or negative correlations, as this reduces overall volatility. Reviewing this data annually helps identify when correlations have shifted due to market changes.

Risk-adjusted return metrics, such as the Sharpe ratio, offer insight into how much return a portfolio generates per unit of risk. A higher Sharpe ratio indicates better performance relative to volatility. While not a standalone decision tool, it helps compare different strategies or funds objectively. For example, two portfolios may deliver 7% annual returns, but if one achieves it with half the volatility, it’s more efficient. These metrics support smarter choices without overcomplicating the process.

Stress testing is another valuable practice. By simulating how a portfolio would perform under historical downturns—like 2008 or 2020—investors can assess resilience. Software tools and financial advisors often provide this analysis, showing potential drawdowns and recovery timelines. It’s not about predicting the future, but preparing for plausible scenarios. Knowing that a diversified portfolio might lose 15% in a crisis—versus 35% for a concentrated one—can reinforce commitment during real stress.

Portfolio analytics platforms now make much of this data accessible to individual investors. Dashboards can display asset allocation, sector exposure, geographic breakdown, and risk scores in clear visuals. These tools don’t replace judgment, but they inform it. The key is consistency: regular check-ins, objective data review, and a willingness to make adjustments before problems grow. Discipline, supported by data, is what turns diversification from theory into practice.

The Long Game: How Diversification Fuels Sustainable Growth

At its core, investing is not about winning every year—it’s about staying in the game for decades. Markets reward patience, not prediction. Diversification supports this long-term mindset by reducing the risk of catastrophic loss. A single market crash can erase years of gains, especially if you’re forced to sell at a low point due to financial need or emotional pressure. A well-diversified portfolio, by contrast, is more likely to preserve capital, allowing time for recovery and continued compounding.

Compounding works best when returns are consistent. A portfolio that gains 10% one year but loses 20% the next doesn’t average 0%—it ends lower overall due to the math of percentage changes. Smoother returns, even if slightly lower in peak years, lead to stronger long-term growth. This is the quiet power of diversification: it sacrifices some upside to avoid devastating downside, creating a more reliable path to wealth accumulation.

Moreover, a diversified approach fosters emotional stability. When markets decline, it’s easier to stay invested if you know not everything is falling at once. This behavioral advantage is often overlooked but critically important. Studies show that investor behavior—buying high and selling low—is one of the biggest drags on returns. Diversification acts as a psychological anchor, helping investors avoid reactive decisions that undermine their goals.

Finally, diversification builds adaptability. The economy evolves, new industries emerge, and old ones decline. A rigid portfolio tied to yesterday’s winners struggles to keep pace. A diversified one, with room for adjustment and reinvention, can shift gradually without disruption. It’s not about chasing every trend, but about maintaining flexibility to respond to change. In this way, diversification isn’t just a defensive tactic—it’s a foundation for enduring financial health.

Diversification isn’t flashy, but it’s foundational. It won’t make headlines during bull runs, yet it quietly protects when markets turn. As fund managers or individual investors, our job isn’t to predict the future—but to prepare for it. By spreading risk wisely, staying alert to hidden flaws, and sticking to a clear plan, we build portfolios that endure. In the end, lasting success comes not from picking winners, but from avoiding ruin.