How I Found the Right Investments for My Retirement Fun — Without the Stress

What if your retirement money could support both security and joy? I used to think planning for later years meant cutting back on everything, especially fun. But after years of trial, error, and smart adjustments, I discovered how to align my investments with a vibrant, active lifestyle. It’s not about chasing returns—it’s about choosing financial products that truly fit how you want to live. Let me walk you through what actually worked. The journey wasn’t about finding the highest-yielding stock or the most aggressive fund. Instead, it was about building a strategy that allowed me to travel when I wanted, attend concerts, take up new hobbies, and say yes to spontaneous weekend trips—without checking my balance first. That kind of freedom didn’t come from luck. It came from rethinking what retirement investing really means.

The Hidden Cost of Boring Retirement Planning

For decades, the standard retirement message has been clear: play it safe, minimize risk, and preserve capital at all costs. The advice often leads retirees toward ultra-conservative portfolios filled with low-yield bonds, savings accounts, and guaranteed instruments that promise stability but deliver little growth. While these choices may protect against short-term market drops, they carry a hidden price—one that doesn’t show up on a balance sheet but reveals itself in daily life. That cost is the gradual erosion of enjoyment, the slow retreat from experiences that bring meaning and energy to the later years.

Consider the emotional toll of living with constant financial caution. When every purchase feels like a risk, even small pleasures—dining out, attending a theater performance, or visiting family across the country—can trigger anxiety. Over time, this mindset shifts from prudent to restrictive. Retirees begin to equate financial safety with self-denial, believing that fun must be sacrificed to avoid running out of money. But research in behavioral finance and well-being consistently shows that emotional fulfillment is a critical component of long-term health. A 2020 study published in the Journal of Aging and Health found that retirees who regularly engaged in leisure activities reported higher levels of life satisfaction and lower rates of depression, regardless of income level. This suggests that access to discretionary spending isn’t a luxury—it’s a necessity for a high-quality retirement.

The problem lies in how traditional planning defines success. Too often, financial advisors measure retirement readiness by account balances and withdrawal rates, without asking what the retiree actually wants to do with their time. A portfolio that covers basic living expenses but leaves no room for enjoyment fails a fundamental test: does it support the life the person hopes to live? When retirees suppress their lifestyle desires out of fear, they may avoid financial ruin, but they risk another kind of depletion—one of spirit and engagement. The solution isn’t to abandon caution but to expand the definition of financial security to include the ability to enjoy life without guilt or stress.

Redefining Risk: It’s Not Just About Market Volatility

When most people think of investment risk, they picture a stock market crash—the kind of sudden drop that wipes out 20% or more of a portfolio in a single year. This fear drives many retirees toward low-volatility assets, believing they are protecting themselves. But in doing so, they often overlook far more dangerous risks: longevity, inflation, and lifestyle constraints. True financial risk in retirement isn’t just about losing money in the short term. It’s about failing to maintain a desired standard of living over a span that could last three decades or more.

Longevity risk—the chance of outliving your savings—is one of the most underestimated threats. With average life expectancy for a 65-year-old now exceeding 85 in many developed countries, a retirement portfolio must last 20 to 30 years. Relying solely on low-yield instruments like savings accounts or short-term CDs may preserve principal, but they rarely generate enough growth to sustain spending over such a long period. For example, a retiree withdrawing 4% annually from a portfolio earning just 1.5% in interest will deplete their savings in under two decades, even without accounting for inflation. The danger isn’t volatility—it’s erosion through insufficient returns.

Inflation risk compounds this problem. Over time, the purchasing power of money declines. Historically, inflation in the U.S. has averaged about 3% per year. That means a dollar today will be worth only about 45 cents in 30 years. A portfolio that doesn’t earn at least enough to keep pace with inflation will gradually lose its ability to fund even basic expenses, let alone leisure activities. A retiree who depends entirely on fixed-income assets may find that their “safe” investments become less safe over time, simply because they no longer stretch as far.

Liquidity risk is another silent threat. Some financial products, such as long-term fixed annuities or certificates with early withdrawal penalties, lock up money for years. While they offer predictable returns, they can make it difficult to respond to changing desires or opportunities. Imagine wanting to take a dream trip or visit grandchildren abroad, only to find that your funds are tied up for another five years. The inability to access money when you want it can be just as damaging as losing it. By redefining risk to include these dimensions—longevity, inflation, and liquidity—retirees can build portfolios that don’t just survive but support a dynamic, fulfilling life.

Matching Products to Lifestyle Goals, Not Just Returns

Choosing financial products should be less about chasing the highest yield and more about alignment with how you want to live. A 6% return means little if the money isn’t available when you need it or if the investment carries hidden restrictions. The key is to evaluate each option not by its headline number but by how well it supports reliable, usable income for the activities that matter. This shift in perspective transforms investing from a numbers game into a lifestyle strategy.

Take dividend-paying stocks, for example. Unlike growth stocks that reinvest profits, dividend stocks distribute a portion of earnings to shareholders, often on a quarterly basis. For retirees, this creates a natural income stream that can be used for travel, dining, or hobbies. While these stocks do fluctuate in value, a well-chosen portfolio of established companies with a history of consistent dividends can offer both modest growth and steady payouts. The benefit isn’t just financial—it’s psychological. Receiving regular income, even if small, reinforces the sense that your money is working for you in a tangible way.

Annuities are another tool that, when used appropriately, can provide predictable income. Immediate annuities, for instance, convert a lump sum into a guaranteed monthly payment for life. This can be especially useful for covering essential expenses, freeing up other assets for discretionary spending. However, not all annuities are created equal. Some come with high fees, complex terms, or limited access to principal. The goal isn’t to eliminate risk entirely but to use annuities selectively—perhaps allocating a portion of savings to secure a baseline income while keeping the rest flexible.

Real Estate Investment Trusts (REITs) offer another avenue for income. By investing in commercial or residential properties, REITs generate rental income that is passed on to investors. Many REITs pay dividends monthly, providing a rhythm that aligns well with lifestyle spending. Bonds, particularly high-quality municipal or corporate bonds, can also play a role. While their yields may be modest, they tend to be more stable than stocks and can be timed to mature when funds are needed. The key is to view each product not in isolation but as part of a coordinated system designed to deliver income when and how you want it.

The Income Flow Strategy: Building a Fun-Funded Calendar

One of the most effective ways to ensure consistent access to spending money is to design an income flow strategy—essentially a financial calendar that delivers funds on a predictable schedule. Instead of relying on irregular withdrawals or market timing, this approach uses a sequence of investments with staggered payout dates to create a steady stream of usable cash. The result is peace of mind: knowing that “fun money” will arrive like a paycheck, regardless of what the stock market is doing.

The concept is similar to a bond ladder, but tailored for lifestyle needs. Imagine allocating a portion of your portfolio to bonds or certificates of deposit (CDs) with maturities spread over the next five to ten years. One might mature in 12 months, another in 24, then 36, and so on. As each instrument matures, the principal and interest become available for spending or reinvestment. This structure provides built-in liquidity and reduces the temptation to sell investments during market downturns. It also allows you to plan ahead—knowing that a certain amount will be accessible each year makes it easier to book trips or sign up for classes without stress.

Dividend stocks and REITs can be layered into this system to fill in the gaps. If you receive quarterly dividends, you can treat them as supplemental income between maturity dates. By aligning the timing of these payouts with anticipated expenses—such as planning a vacation in the summer and ensuring a bond matures in June—you create a rhythm that matches your life. This doesn’t require complex financial models. It simply asks you to think ahead and coordinate your holdings so that money flows in when you need it, not just when the market allows it.

The psychological benefit of this approach is profound. Many retirees hesitate to spend, even when they have enough, because they fear making the wrong move. An income flow strategy removes much of that uncertainty. When you know that funds are scheduled to arrive, spending feels less like a risk and more like a reward. It transforms retirement from a phase of restriction to one of anticipation and enjoyment.

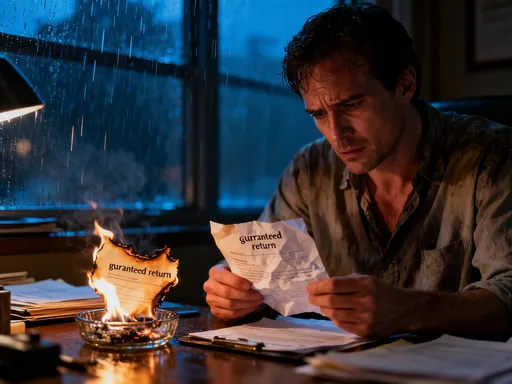

Avoiding the Liquidity Trap in Pursuit of Stability

In the search for safety, many retirees fall into the liquidity trap—sacrificing access to their money in exchange for the illusion of security. Products like long-term fixed annuities, non-traded REITs, or high-penalty CDs often promise steady returns, but they come with a significant trade-off: your money is locked up, sometimes for a decade or more. While this might sound acceptable in theory, it can be deeply limiting in practice. Life doesn’t follow a rigid schedule, and the ability to respond to changing desires or unexpected opportunities is a crucial part of a fulfilling retirement.

Consider the retiree who invests $50,000 in a 10-year fixed annuity offering a 4% return. On paper, it seems safe and predictable. But what happens if, in year three, a grandchild gets married overseas and the family wants to attend? Or if a limited-time tour to a dream destination becomes available? With funds locked in, the choice becomes stark: pay hefty surrender charges, forgo the experience, or dip into other savings that might not be as secure. The cost of illiquidity isn’t just financial—it’s emotional. Missing out on meaningful moments because money is inaccessible can lead to lasting regret.

The solution isn’t to avoid stable products altogether but to balance them with accessible ones. A better approach is to divide your portfolio into tiers based on time horizon and purpose. Short-term needs—like annual travel or entertainment—should be funded with liquid assets such as money market accounts, short-term bonds, or dividend stocks. Medium-term goals can use intermediate bonds or CDs with moderate maturities. Only a portion of savings should go into longer-term, less liquid instruments, and even then, only after careful consideration of fees, penalties, and access terms. This tiered structure preserves stability without sacrificing flexibility.

Liquidity also supports confidence. When you know you can access funds if needed, you’re more likely to spend on experiences that enrich your life. That doesn’t mean reckless spending—it means intentional, joyful use of your resources. Financial security isn’t just about having money; it’s about having the freedom to use it when it matters most.

Why Simplicity Beats Complexity in Retirement Portfolios

It’s easy to believe that a more complex portfolio must be more effective—that adding more products, strategies, or layers will improve results. But in retirement, the opposite is often true. Complexity increases the risk of mistakes, raises costs, and makes decision-making harder at a time when clarity is most needed. A simpler portfolio, with fewer, well-understood holdings, often delivers better outcomes and greater peace of mind.

Consider two hypothetical retirees. The first has a portfolio of five clear investments: a dividend stock fund, a bond ladder, a low-cost index fund, a money market account, and a small immediate annuity. Each serves a distinct purpose, fees are transparent, and the income flow is predictable. The second retiree holds twelve different products, including multiple annuities, non-traded REITs, structured notes, and international funds. On the surface, this looks diversified. But in reality, many holdings overlap in risk and return, fees are hidden or high, and it’s difficult to track performance or understand tax implications. When it comes time to withdraw money, the second retiree faces confusion and hesitation—exactly the opposite of what retirement should feel like.

Simplicity reduces friction. With fewer moving parts, it’s easier to monitor performance, rebalance when needed, and make informed decisions about spending. It also lowers costs. Complex products often come with higher management fees, commissions, or administrative charges that erode returns over time. A 2019 study by Morningstar found that low-cost funds consistently outperformed high-cost ones over long periods, even when they held similar assets. The savings from lower fees can be substantial—enough to fund additional travel or experiences over a decade.

Perhaps most importantly, simplicity builds confidence. When you understand your portfolio, you’re more likely to trust it. That trust allows you to spend without guilt, knowing that your financial foundation is sound. A retiree who can explain their investment strategy in a few clear sentences is in a much stronger position than one who relies on a thick binder of product brochures. Clarity isn’t just convenient—it’s empowering.

Putting It All Together: A Realistic, Sustainable Approach

Building a retirement portfolio that supports both security and joy doesn’t require extraordinary returns or complex strategies. It requires intention, balance, and a clear understanding of what you want your later years to look like. The framework that emerged from my own journey—and that continues to serve me well—rests on three pillars: reliable income, moderate growth, and easy access.

Reliable income forms the foundation. This comes from a mix of dividend stocks, bond ladders, and a modest immediate annuity, structured to deliver consistent cash flow throughout the year. These assets cover both essential expenses and a set amount for discretionary spending, ensuring that fun isn’t an afterthought but a planned part of life. Moderate growth is achieved through a diversified stock fund or ETF, held in a tax-advantaged account and left largely untouched. This portion of the portfolio isn’t meant for spending but for long-term preservation of purchasing power, helping to offset inflation over time. Easy access is maintained through a tiered liquidity structure: short-term needs are funded with liquid assets, while longer-term holdings are timed to mature when funds are expected to be needed.

This approach isn’t about maximizing wealth. It’s about maximizing well-being. It acknowledges that retirement is not just a financial phase but a life stage—one that should be filled with engagement, connection, and joy. By choosing financial products that align with real-life goals, retirees can move beyond fear and into freedom. They can say yes to experiences without hesitation, knowing their money is structured to support them. They can enjoy the present while still protecting the future.

The most valuable outcome of this strategy isn’t a higher account balance. It’s the ability to live fully, without stress. It’s the confidence that comes from knowing your finances are not a source of anxiety but a tool for living well. Retirement doesn’t have to mean settling for less. With thoughtful planning, it can mean enjoying more—more time, more experiences, more peace of mind. And that, in the end, is the true measure of financial success.