How I Tamed the Cost of Cosmetic Surgery Without the Financial Pain

What if you could get the look you want without wrecking your wallet? I once stood where you are—excited but scared—facing skyrocketing cosmetic surgery costs. I didn’t want to risk debt or regret. So I dug deep, compared options, and found ways to cut risks and costs—smartly. This isn’t about cutting corners; it’s about making informed moves. Let me walk you through how to protect your money while achieving your goals, one careful step at a time.

The Hidden Price of Looking Perfect

Cosmetic surgery is often sold as a single-line expense: the cost of the procedure. But the reality is far more complex. The sticker price advertised online or quoted during a brief consultation is rarely the full story. Behind that number lie multiple layers of additional costs that, if ignored, can transform an affordable plan into a financial burden. These include pre-operative tests, anesthesia fees, facility charges, surgical garments, prescription medications, and follow-up visits. For example, a facelift quoted at $8,000 may end up costing closer to $12,000 once all supporting services are factored in. This gap between expectation and reality is where many patients find themselves unprepared.

Geographic location also plays a significant role in pricing. Major metropolitan areas like New York or Los Angeles typically have higher average costs due to elevated overhead, demand, and surgeon expertise. In contrast, clinics in smaller cities or suburban regions may offer similar services at reduced rates. However, lower prices do not always mean better value. Some patients consider traveling abroad for so-called “medical tourism,” where procedures in countries like Thailand or Mexico can appear dramatically cheaper. While savings are possible, these options often come with hidden risks—such as limited legal recourse, language barriers, and inconsistent medical standards—that can lead to costly complications requiring corrective surgery back home.

Another overlooked aspect is the potential for revision surgeries. Not every outcome is perfect on the first try. Some procedures, particularly those involving implants or body contouring, may require adjustments. Revision surgeries are rarely included in the initial quote and can cost 50% to 100% of the original price. Additionally, complications such as infections, blood clots, or adverse reactions to anesthesia may necessitate emergency care, hospitalization, or extended recovery time—each carrying its own financial implications. These possibilities underscore the importance of viewing cosmetic surgery not as a one-time purchase, but as a financial commitment with potential long-term obligations.

Understanding this full financial picture allows for more realistic budgeting. It shifts the conversation from “Can I afford the surgery?” to “Can I afford the entire process, including the unexpected?” This mindset is crucial for avoiding debt, minimizing stress, and ensuring that the pursuit of aesthetic improvement does not come at the expense of financial stability. The goal is not to scare patients away from surgery, but to equip them with the awareness needed to make sound decisions. When the full cost is transparent, patients can evaluate whether the investment aligns with their personal and financial goals—and plan accordingly.

Why Risk Control Beats Cost Chasing

It’s natural to want the lowest price when facing a major expense. But when it comes to cosmetic surgery, prioritizing cost over safety can lead to outcomes far more damaging than overspending. A surgeon offering a breast augmentation for $3,000 when the regional average is $7,000 may seem like a bargain—until complications arise. That lower fee might reflect limited training, outdated equipment, or a facility that doesn’t meet accreditation standards. In some cases, it could even indicate a lack of malpractice insurance, leaving patients financially exposed if something goes wrong.

Risk control begins with due diligence. The first step is verifying a surgeon’s credentials. Board certification by a recognized body, such as the American Board of Plastic Surgery, ensures that the provider has undergone rigorous training and adheres to established safety protocols. Patients should also confirm that the surgical facility is accredited by organizations like the Accreditation Association for Ambulatory Health Care (AAAHC) or the Joint Commission. These accreditations mean the facility meets national standards for infection control, emergency preparedness, and equipment maintenance—factors that directly impact patient safety.

Another critical element is understanding the surgeon’s revision policy. Some practices include one revision within a set timeframe at no additional cost, while others charge full price for any follow-up procedures. Knowing this in advance helps avoid surprise expenses and reflects the surgeon’s confidence in their work. Similarly, reviewing before-and-after photos of actual patients—not stock images—provides insight into the consistency and quality of results. Patient testimonials, especially those found on independent review platforms, can also reveal patterns in care quality and post-operative support.

The financial logic of prioritizing safety becomes clear over time. A slightly higher upfront cost with a qualified surgeon often results in fewer complications, reduced need for revisions, and smoother recovery—all of which translate into lower overall expenses. In contrast, a low-cost procedure that leads to infection, scarring, or asymmetry may require multiple corrective surgeries, extended time off work, and additional medical bills. In this context, the most expensive option isn’t always the one with the highest initial price tag, but the one that fails to deliver safe, lasting results. By shifting focus from cost chasing to risk control, patients protect not only their health but their financial well-being.

Smart Planning: Budgeting That Actually Works

Approaching cosmetic surgery without a financial plan is like building a house without a blueprint—it may stand, but it’s far more likely to develop structural flaws. A well-structured budget does more than set a spending limit; it creates a framework for decision-making, prioritization, and long-term financial health. The first step is determining what you can realistically afford without disrupting essential obligations like mortgage payments, retirement savings, or children’s education. This means looking at your income, fixed expenses, and discretionary spending to identify how much can be allocated toward surgery—without relying on debt.

One effective strategy is to treat cosmetic surgery as a planned expense, similar to a home renovation or vacation. By setting aside a fixed amount each month into a dedicated savings account, you build the fund gradually and avoid the pressure of last-minute financing. For example, saving $300 per month for two years accumulates $7,200—enough to cover many common procedures without interest or credit checks. This approach also allows time for research, consultations, and price comparisons, leading to more thoughtful decisions.

Medical savings accounts, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), can also play a role—if the procedure qualifies. While most cosmetic surgeries are considered elective and therefore not eligible for tax-advantaged accounts, exceptions exist for reconstructive work following injury, illness, or congenital conditions. In such cases, using HSA or FSA funds can provide significant tax savings. Even when not applicable, maintaining a separate health-related savings account fosters discipline and ensures funds are available for unexpected medical costs during recovery.

Prioritization is another key component of smart planning. If multiple procedures are desired—such as a tummy tuck, liposuction, and breast lift—it’s often more economical and safer to stage them over time rather than combining them in a single surgery. Bundling procedures may reduce facility fees, but it also increases anesthesia time, surgical risk, and recovery complexity. Staging allows for better financial management, lower physical strain, and the ability to assess results before proceeding. It also prevents the temptation to stretch beyond your means for the sake of convenience. Ultimately, a strong budget isn’t just about affordability—it’s about sustainability. It ensures that your pursuit of aesthetic goals doesn’t compromise your financial future.

Comparing Options Without Losing Your Mind

With countless clinics, surgeons, and marketing messages competing for attention, comparing cosmetic surgery options can feel overwhelming. The key to navigating this landscape is developing a systematic approach that prioritizes transparency, consistency, and long-term value over flashy promotions or viral before-and-after photos. Start by compiling a shortlist of surgeons in your region or within reasonable travel distance. Use official directories, such as those provided by the American Society of Plastic Surgeons, to ensure candidates are board-certified and in good standing.

Once you have a list, schedule consultations—not just to discuss the procedure, but to evaluate the practice’s communication style, office environment, and level of detail in cost breakdowns. A reputable provider will offer a comprehensive quote that itemizes every component: surgeon’s fee, anesthesia, facility costs, medical tests, and post-operative supplies. Be cautious of clinics that provide vague estimates or pressure you to make a decision during the first visit. Transparency is a hallmark of ethical practice, and a clear, written quote is a sign of professionalism.

While reviewing prices, watch for red flags. Quotes that are significantly below the regional average often indicate corners being cut—whether in staffing, sterilization, or emergency preparedness. Similarly, clinics that offer “limited-time discounts” or “free consultations with surgery booking” may be using high-pressure sales tactics rather than focusing on patient care. These strategies can cloud judgment and lead to rushed decisions. Instead, look for consistency in pricing and a willingness to answer questions without urgency or persuasion.

Another valuable tool is patient feedback. While no surgeon has perfect reviews, patterns matter. Repeated complaints about poor communication, unexpected charges, or complications suggest systemic issues. Independent platforms like RealSelf or Healthgrades can provide balanced perspectives, but it’s important to read critically—some reviews may be biased or outdated. Whenever possible, seek out in-person testimonials or speak with patients who have undergone similar procedures. Their firsthand experiences offer insights no brochure or website can match. By applying a disciplined, evidence-based approach to comparison, you gain confidence in your choice and reduce the risk of regret.

Financing Without Falling Into Debt Traps

For many, saving enough to pay for cosmetic surgery outright isn’t feasible within their desired timeframe. In these cases, financing becomes a necessary tool—but one that must be used with caution. Medical loans, in-house payment plans, and credit card offers are commonly promoted by clinics, often with promises of low monthly payments or interest-free periods. While these options can make surgery seem more accessible, they carry risks that can turn manageable debt into a long-term burden.

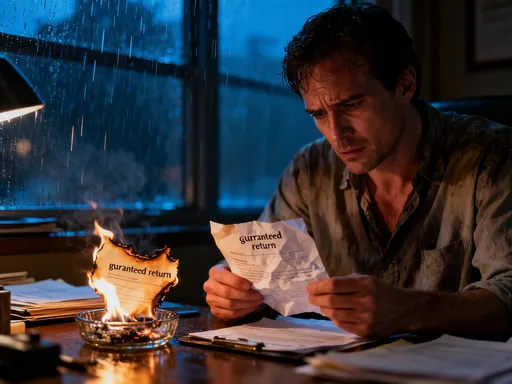

One of the most common pitfalls is the deferred interest model. A clinic may advertise “12 months no interest,” but if the full balance isn’t paid by the end of the promotional period, all accrued interest is applied retroactively—from day one. This can result in hundreds or even thousands of dollars in unexpected charges. For example, a $10,000 procedure with 18% APR could accrue $1,800 in interest if not paid off in time. To avoid this, read the fine print carefully and calculate whether you can realistically repay the full amount within the interest-free window.

Another concern is the impact on credit. Applying for multiple financing options can trigger hard inquiries on your credit report, potentially lowering your score. A lower credit score affects your ability to secure favorable rates on future loans, such as mortgages or car purchases. Additionally, missed or late payments on medical debt can damage your credit history, creating long-term financial consequences. Before committing, assess your ability to make consistent payments without straining your budget.

When evaluating financing, compare offers from multiple sources—not just the clinic’s in-house plan. Banks, credit unions, and online lenders may offer lower interest rates or more flexible terms. Some financial institutions provide personal loans specifically for medical expenses with fixed rates and predictable payments. These options often provide greater transparency and consumer protection than proprietary financing programs. The goal is to use credit as a strategic tool, not a shortcut that leads to financial strain. By choosing financing wisely, you maintain control over your budget and protect your long-term financial health.

The Insurance and Safety Net Factor

It’s a common misconception that all cosmetic surgery is entirely self-funded. While most aesthetic procedures—like rhinoplasty for appearance or elective liposuction—are not covered by health insurance, there are exceptions. Reconstructive surgeries following mastectomy, trauma, or congenital deformities often qualify for coverage under federal laws like the Women’s Health and Cancer Rights Act. Even in cases where the primary goal is aesthetic improvement, if a procedure addresses functional issues—such as correcting breathing problems with rhinoplasty or alleviating back pain with breast reduction—insurance may cover part or all of the cost. Patients should always submit a claim or request a pre-authorization review, even if they expect denial. In some cases, partial reimbursement is possible, reducing out-of-pocket expenses.

Beyond traditional insurance, specialized surgical complication insurance is an emerging option. These policies, offered by select providers, cover the cost of corrective surgery if complications arise from the initial procedure. While not widely available, they can provide peace of mind for high-risk or complex surgeries. Premiums vary based on procedure type, patient health, and surgeon credentials, but the cost is typically a small fraction of potential revision expenses. For patients undergoing significant transformations, this type of coverage can serve as a financial safety net.

Equally important are non-insurance buffers. Building an emergency fund specifically for recovery-related expenses—such as lost wages, childcare, or physical therapy—ensures that unexpected delays don’t derail your budget. Family or community support networks can also play a role, providing transportation, meal preparation, or emotional encouragement during recovery. These intangible resources reduce stress and allow for better healing, indirectly protecting your financial stability by minimizing the need for paid services.

Planning for the worst-case scenario isn’t pessimistic—it’s prudent. Just as homeowners insure against fire and drivers carry collision coverage, patients should consider the financial implications of surgical setbacks. By combining available insurance options, specialized policies, and personal safeguards, you create a layered defense against unforeseen costs. This holistic approach ensures that your investment in appearance is protected not just by skill and planning, but by resilience.

Making the Final Call: Confidence Over Regret

The moment before surgery is often filled with emotion—hope, excitement, and a touch of fear. But if you’ve followed a disciplined financial and medical evaluation process, that fear can be tempered with confidence. The final decision should not be driven by urgency, peer pressure, or fleeting trends, but by a clear understanding of what you’re investing in and why. You’ve researched surgeons, compared costs, planned your budget, evaluated financing, and considered safety nets. Now, you’re not just choosing a procedure—you’re affirming a commitment to yourself, made with clarity and care.

Regret in cosmetic surgery often stems not from the outcome, but from the process. Patients who rush into decisions, ignore red flags, or stretch beyond their means are more likely to experience dissatisfaction—even if the surgery is technically successful. On the other hand, those who take time to prepare, ask questions, and align the decision with their financial reality tend to report higher satisfaction. The peace of mind that comes from knowing you’ve minimized risks and protected your future is as valuable as the physical transformation itself.

Remember, cosmetic surgery is not a one-time event, but a journey with financial, emotional, and physical dimensions. By treating it as such, you shift from being a passive consumer to an informed participant. You gain not only the appearance you desire, but the confidence that comes from making empowered choices. And when you look in the mirror after recovery, you’ll see more than a new look—you’ll see the reflection of careful planning, thoughtful decisions, and lasting financial wisdom. That is the true reward.