How I Smartly Fund Winter Camp Without Breaking the Bank

Every year, winter camp costs creep up, and I used to stress over the bill—until I changed my approach. Instead of just saving more, I started working *with* market trends to make smarter financial moves. I tested different strategies, from timing payments to leveraging flexible investment vehicles, and finally found a method that actually works. Here’s how I turned rising education expenses into a manageable, even strategic, part of my family’s financial plan—without risking everything. It wasn’t about earning more or cutting corners; it was about aligning my money with real economic patterns and making informed, calm decisions months before the deadline. This shift didn’t just ease the pressure—it gave me confidence that we could handle what comes next.

The Rising Pressure of Winter Camp Costs

Over the past decade, winter camp fees have increased at nearly twice the rate of general inflation, placing growing strain on household budgets. According to national education spending reports, the average cost of a two-week winter camp program has risen from $650 in 2015 to over $1,100 in 2024. For families with multiple children, this can mean an annual outlay exceeding $2,500—equivalent to a mid-range vacation or several months of groceries. These increases are driven by a combination of rising operational costs, higher staffing wages, and increased demand for specialized programming such as STEM workshops, language immersion, or outdoor leadership training. Providers are investing in quality, safety, and curriculum development, and those improvements come with a price.

This isn’t just a one-time spike—it’s a structural shift. Enrollment data shows that participation in winter programs has grown steadily, particularly among families seeking enrichment during school breaks. As demand rises, providers adjust pricing accordingly, often announcing fee increases in the fall, just as registration opens. This timing creates pressure to commit quickly, sometimes before families have fully assessed their finances. The result? Many parents end up making rushed decisions, using high-interest credit cards or dipping into emergency funds to cover the cost. These reactive moves can trigger longer-term financial stress, including delayed bill payments, reduced retirement contributions, or increased household debt.

What makes this challenge especially difficult is that winter camp costs are often treated as discretionary, even though many families rely on them for childcare during school holidays. Unlike tuition or rent, these expenses don’t come with predictable billing cycles or long-term contracts, making them easy to overlook until the last minute. But treating them as optional can backfire. When families delay planning, they lose the advantage of time—the most powerful tool in financial management. By the time the invoice arrives, there’s little opportunity to adjust, save, or explore alternatives. The consequence is a recurring cycle of anxiety and financial strain each winter season.

Recognizing this pattern is the first step toward change. Winter camp is no longer a minor line item; it’s part of a broader trend of rising educational enrichment costs. From summer academies to private lessons, families are spending more than ever to support their children’s development. And while these investments can yield real benefits, they must be managed strategically. Ignoring the trend won’t make it disappear. The smarter path is to acknowledge the reality of rising prices and build a system that keeps pace—without sacrificing financial stability.

Why Traditional Savings Aren’t Enough Anymore

For generations, the standard advice for covering future expenses was simple: open a savings account and set aside money each month. This approach worked reasonably well when interest rates were higher and inflation was lower. But today’s financial environment has changed. The average annual percentage yield (APY) on a traditional savings account is around 0.45%, while high-yield options may offer up to 4.5% depending on market conditions. At the same time, the cost of winter camp and similar programs is increasing at an average rate of 6% per year. This gap means that money sitting in a standard savings account is actually losing purchasing power over time—even if the balance appears to grow slightly.

The problem isn’t with saving itself; it’s with the assumption that all savings are equal. A dollar saved today may not buy the same experience tomorrow if it’s not earning enough to keep up with price increases. This concept, known as inflation risk, is often overlooked in household budgeting. Many families believe they’re being responsible by setting money aside, not realizing that the value of those dollars is quietly eroding. For example, if a camp costs $1,000 this year and increases by 6%, next year’s price will be $1,060. But if only $1,020 was saved in a 2% interest account, the family still faces a $40 shortfall—and that gap widens each year.

Another limitation of traditional savings is liquidity bias—the tendency to keep funds in easily accessible accounts “just in case” something comes up. While having emergency access is important, it often leads to underperformance. Money that could be earning higher returns in better-structured vehicles stays parked in low-yield accounts out of habit or caution. This isn’t reckless behavior; it’s a rational response to uncertainty. But it becomes a problem when applied to known, predictable expenses like winter camp. These costs aren’t unexpected—they recur annually, with clear timelines and registration windows. That predictability makes them ideal candidates for more strategic funding.

The takeaway isn’t that savings accounts are bad—they remain essential for short-term needs and emergency reserves. But for known future expenses, especially those rising faster than inflation, a more dynamic approach is needed. Families need to think beyond preservation and focus on growth that matches or exceeds cost increases. This doesn’t mean taking on high risk; it means using tools that offer better returns with manageable volatility. The goal isn’t to become investors overnight, but to make smarter use of the money already being set aside.

Aligning Your Money with Market Trends

Rather than resisting economic forces, the most effective financial strategies learn to move with them. Interest rates, seasonal demand, and yield cycles all influence how money grows—and when timed well, these trends can work in a family’s favor. For instance, when the Federal Reserve raises interest rates, many financial institutions increase the yields on savings vehicles like money market accounts and short-term certificates of deposit (CDs). These rate-sensitive tools can offer returns closer to 4% or 5%, helping funds keep pace with rising camp costs. By aligning deposits with rising rate environments, families can capture higher earnings without extending their risk profile.

Seasonal patterns also play a role. Many financial institutions introduce promotional rates in the fall—coinciding with the start of winter camp registration—to attract new deposits. Some credit unions offer limited-time CD specials with slightly better terms for accounts opened between September and November. These opportunities are often overlooked because families aren’t actively monitoring financial products during this period. But by paying attention to timing, a household can lock in a favorable rate just as they begin funding their camp payments. This isn’t about market timing in the speculative sense; it’s about strategic alignment—placing money where it can grow most efficiently during predictable economic windows.

Another example is the use of Treasury securities, particularly Series I Savings Bonds, which are designed to protect against inflation. These bonds earn interest based on a fixed rate plus an inflation-adjusted rate that changes every six months. When inflation rises, so does the return. For families planning 12 to 18 months ahead, I Bonds can serve as a low-risk tool to preserve purchasing power. While they have holding period restrictions, they offer a valuable hedge against rising costs. The key is starting early enough to benefit from compounding and inflation adjustments before the expense is due.

Working with market trends also means avoiding emotional decisions. It’s tempting to pull funds out of savings when stock markets dip or economic news sounds alarming. But for a goal like winter camp, which is short-term and non-negotiable, volatility in long-term markets shouldn’t dictate choices. Instead, the focus should be on stable, predictable growth vehicles that respond to broader economic shifts without exposing the family to unnecessary risk. Strategy, not reaction, is what turns market movements into advantages.

A Practical 3-Step Method for Funding Winter Camp

The most effective way to manage rising winter camp costs is through a structured, repeatable process. This three-step method—forecast, allocate, adjust—turns financial planning from a source of stress into a predictable routine. It’s designed for families who want control, clarity, and confidence without needing advanced financial knowledge. Each step builds on the previous one, creating a system that adapts to real-world changes while staying within safe risk boundaries.

Step one is forecasting. This begins in the spring or early summer, well before registration opens. Families should gather historical pricing data from camp providers—either from past invoices or published rates. Many organizations release next year’s fees by May or June. By analyzing year-over-year increases, it’s possible to estimate the upcoming cost with reasonable accuracy. For example, if fees rose 6% last year and 5.8% the year before, projecting a 6% increase is a prudent assumption. Adding a 5% buffer for unexpected changes brings the target to a realistic, slightly conservative figure. This number becomes the funding goal for the year.

Step two is allocation. Once the target is set, the total amount is divided across different financial vehicles based on time horizon and risk tolerance. A portion—say 40%—goes into a high-yield savings account for immediate liquidity and safety. Another 40% might be placed in a short-term CD or money market fund with a maturity date just before registration opens. The remaining 20% could go into a slightly higher-yielding option like an I Bond or a dividend-paying money market ETF, provided the timeline allows. This tiered approach balances growth potential with security, ensuring that funds are protected while still earning competitive returns.

Step three is monitoring and adjusting. This isn’t a “set and forget” system. Every few months, families should review their allocations in light of changing interest rates, inflation data, or personal financial shifts. If CD rates rise significantly in the fall, it may make sense to roll over part of the savings into a new, higher-yielding certificate. If inflation spikes, increasing the allocation to inflation-protected securities could be wise. The goal is to make small, informed adjustments—not emotional overhauls. By staying engaged throughout the year, families maintain control and avoid last-minute surprises.

Balancing Risk and Return in Education Spending

When saving for a specific, time-bound goal like winter camp, the objective isn’t to maximize returns—it’s to minimize the risk of falling short. This requires a disciplined approach to risk management. The temptation to chase higher yields can lead to overexposure in volatile assets, such as individual stocks or speculative funds. While these may offer attractive returns in bull markets, they also carry the risk of losses that could jeopardize the ability to pay for camp. For a short-term goal, capital preservation must remain the priority.

Diversification within the short-term portfolio is key. Spreading funds across different types of low-volatility instruments reduces exposure to any single risk. For example, combining a high-yield savings account with a short-term bond fund and an I Bond creates a buffer: if one vehicle underperforms, others may compensate. This isn’t about complex investing—it’s about smart distribution. Even within “safe” assets, variety matters. Different institutions offer different rates, terms, and protections, and using more than one increases flexibility.

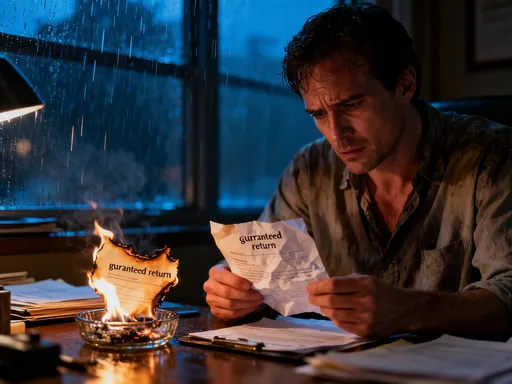

Equally important is emotional discipline. Financial decisions made under pressure—especially close to registration deadlines—tend to be reactive rather than strategic. Families may resort to credit cards, payday loans, or withdrawing from retirement accounts to cover the cost. These choices can have long-term consequences. Building a system that removes emotion from the process helps prevent these pitfalls. By setting a plan early and sticking to it, families avoid the stress of last-minute scrambling and the costly decisions that come with it.

The principles of balancing risk and return apply far beyond winter camp. Whether funding summer programs, music lessons, or academic tutoring, the same framework can be used. The goal is not to eliminate risk entirely—that’s impossible—but to manage it in a way that aligns with the family’s values, timeline, and financial reality. A well-structured plan doesn’t guarantee perfect outcomes, but it significantly improves the odds of success.

Common Mistakes That Drain Family Budgets

Many families fall into predictable financial traps when dealing with seasonal education expenses. One of the most common is procrastination. Waiting until November or December to start saving assumes that nine or ten months of catching up is feasible. But with compound growth working in reverse, late starts mean higher monthly contributions and greater strain. A family that waits until October to save $1,200 needs to set aside $400 per month for three months—an unsustainable pace for most budgets. Starting in January would require only $100 per month, a much more manageable amount.

Another widespread error is relying on high-cost credit. Using credit cards to pay camp fees may solve the immediate problem, but if the balance isn’t paid off quickly, interest charges can add hundreds of dollars to the total cost. At a 20% APR, a $1,000 balance carried for six months incurs over $60 in interest—money that could have been avoided with earlier planning. Some families also use home equity lines or personal loans, which may have lower rates but still introduce debt where none is necessary.

A third mistake is overcomplicating the solution. Some parents, eager to earn more, invest in unfamiliar or risky products without understanding the terms. They might buy into high-yield dividend stocks, crypto funds, or speculative ETFs, hoping for quick gains. But these assets are unsuitable for short-term goals. Volatility can erase gains in weeks, leaving families worse off. The pursuit of higher returns shouldn’t override the need for reliability. Simplicity, transparency, and predictability are more valuable than aggressive growth when the goal is certain.

Finally, many families fail to track their progress. Without regular check-ins, it’s easy to lose sight of the target. Life happens—unexpected expenses arise, income fluctuates, priorities shift. But without monitoring, small deviations become big shortfalls. The solution isn’t perfection; it’s consistency. Regular reviews, even brief ones, keep the plan on track and allow for timely corrections.

Building a Sustainable System for Future Expenses

The method described here isn’t just for winter camp—it’s a model for managing any predictable, rising expense. Once families establish the habit of forecasting, allocating, and adjusting, they can apply it to summer programs, academic tutoring, sports fees, or technology upgrades. The core idea is proactive planning: using time, information, and strategy to stay ahead of costs rather than reacting to them. This shift in mindset transforms financial management from a source of anxiety into a tool for empowerment.

What makes this system sustainable is its adaptability. It doesn’t require a large income or complex tools—just consistency and awareness. Families at every income level can benefit by starting small and building over time. Even saving $25 per month from January to December creates a $300 foundation for next year’s camp. When combined with smart placement in interest-bearing accounts, that amount grows further. The power lies in repetition: each year, the process becomes more familiar, more automatic, and more effective.

Staying informed is equally important. Interest rates change, new financial products emerge, and camp providers update their pricing. By maintaining a routine of financial check-ins—quarterly or semi-annually—families can make small adjustments that keep their plans aligned with reality. Subscribing to provider newsletters, following bank rate updates, or using budgeting apps can help track relevant changes without requiring hours of research.

In the end, smart financial planning isn’t about wealth. It’s about strategy, discipline, and peace of mind. By treating winter camp not as a burden but as a predictable part of family life, parents can fund it confidently, without stress or debt. The real reward isn’t just covering the cost—it’s knowing that with the right approach, they’re prepared for whatever comes next.