How I Built a Smarter Investment Layout to Tackle Risk

I used to think investing was just about picking winners—until I got burned. One market dip wiped out months of gains, and I realized I’d put everything in high-risk plays. That’s when I shifted focus: not on chasing returns, but on building a smarter investment layout. This isn’t about timing the market—it’s about structure, balance, and staying protected. I learned that long-term success isn’t measured by how high your portfolio climbs in a bull run, but by how well it holds up when markets turn. The real goal isn’t just to grow wealth, but to preserve it. Here’s how I rebuilt my strategy around resilience, using diversification, discipline, and a clear layout that keeps risk in check without sacrificing growth.

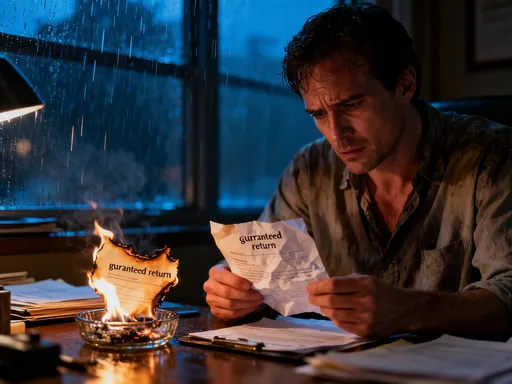

The Wake-Up Call: When Risk Hit Too Close to Home

It started with confidence—maybe too much of it. I had read a few success stories, seen friends talk about double-digit returns, and decided I could beat the averages by focusing on what seemed like the hottest opportunities. I poured a large portion of my savings into a mix of tech stocks and speculative growth funds, convinced I was riding the wave of the future. For a while, it worked. My account balance climbed steadily, and I began to believe I had a knack for spotting winners. But that confidence shattered in a matter of weeks when a broader market correction hit. The stocks I held dropped sharply, some by more than 30 percent in a single quarter. What I thought was a bold strategy turned out to be a fragile house of cards.

The real lesson wasn’t just that markets can fall—it was that my entire portfolio was built on a single assumption: that tech-driven growth would continue indefinitely. I had ignored the basic truth that all investments carry risk, and when too much capital is concentrated in one area, a single downturn can have an outsized impact. I wasn’t being aggressive; I was being undisciplined. That experience forced me to step back and ask a fundamental question: what does a truly resilient investment layout look like? It wasn’t enough to pick assets that might go up. I needed a structure that could withstand volatility, absorb shocks, and keep me on track toward long-term goals, regardless of market conditions.

From that point on, my mindset shifted. I stopped chasing performance and started focusing on design. I began studying how professional investors construct portfolios—not to pick the next big stock, but to understand how different pieces fit together to reduce overall risk. I realized that investing isn’t just about returns; it’s about risk management. And the most powerful tool for managing risk isn’t prediction or timing—it’s structure. A well-organized investment layout doesn’t guarantee profits, but it does increase the odds of coming out ahead over time, even when individual bets don’t work out.

Why Diversification Isn’t Just a Buzzword—It’s a Safety Net

For years, I heard the word “diversification” thrown around like a financial mantra, but I never fully understood what it meant in practice. I assumed it meant owning a few different stocks or funds and calling it a day. But real diversification goes much deeper. It’s about spreading your investments across asset classes that don’t move in the same direction at the same time. When one part of your portfolio struggles, another may hold steady or even gain, helping to smooth out the overall ride. This is the essence of risk control: not avoiding loss entirely, but minimizing its impact so you can stay invested and avoid making emotional decisions during downturns.

I began to see my portfolio not as a collection of individual bets, but as a system. Each asset class plays a role. Equities offer growth potential over time, but they come with volatility. Fixed income, like bonds, tends to be more stable and can provide income even when stocks fall. Real assets, such as real estate or commodities, often behave differently from both stocks and bonds, especially during periods of inflation. And cash or cash equivalents serve as a buffer, giving you flexibility to act when opportunities arise. By combining these pieces, I created a portfolio that wasn’t dependent on any single outcome.

One of the most powerful lessons I learned was about correlation. When two assets are highly correlated, they tend to move together—so if one drops, the other likely will too. But when assets are uncorrelated or negatively correlated, they can move in opposite directions. For example, during times of economic uncertainty, stocks may fall while government bonds rise as investors seek safety. By including both in my portfolio, I reduced the overall volatility. This doesn’t mean I gave up on growth. In fact, over the long term, a diversified portfolio has historically delivered competitive returns with less risk than a concentrated one. The goal isn’t to maximize short-term gains, but to achieve steady, sustainable growth with fewer sleepless nights.

Mapping Your Investment Layout: The Core-Satellite Approach

Once I understood the importance of diversification, I needed a clear way to organize it. That’s when I discovered the core-satellite strategy—a framework that brings structure and discipline to portfolio design. The idea is simple: build a solid “core” of broad, low-cost index funds that represent the overall market, then add smaller “satellite” positions to capture additional opportunities. The core makes up the majority of the portfolio—usually 60 to 80 percent—and provides stability and market-matching returns. The satellites, which are more targeted, allow for strategic bets without jeopardizing the foundation.

For my core, I chose low-cost index funds that track major market benchmarks, such as a total stock market index and a broad bond index. These funds are diversified by design and have low expense ratios, which means more of my returns stay in my pocket. Because they’re passive, they don’t rely on a manager’s ability to pick winners, reducing the risk of underperformance. Over time, these core holdings have delivered consistent, market-aligned results with minimal effort. They are the anchor of my strategy, the part I can count on to keep moving forward even when markets are unpredictable.

The satellite portion is where I allow for more flexibility. This is where I allocate smaller amounts to specific sectors, international markets, or alternative assets that I believe have growth potential. For example, I might add a satellite position in renewable energy or emerging market equities. These aren’t speculative gambles—they’re carefully researched additions that complement the core. Because they make up a smaller portion of the portfolio, even if one underperforms, the overall impact is limited. This structure has helped me stay disciplined. Instead of jumping into hot trends, I evaluate whether an opportunity fits within my satellite framework and aligns with my long-term goals.

Geographic Spread: Don’t Bet Everything on One Economy

For most of my investing life, I focused exclusively on my home market. It felt familiar, safe, and convenient. I assumed that the companies I knew best would naturally be the best place to invest. But that mindset came with a hidden risk: overexposure to a single economy. I didn’t realize how vulnerable I was until a domestic recession slowed corporate earnings and dragged down my portfolio. That experience taught me a valuable lesson: no single country or region dominates growth forever. Economic cycles vary, and when one market struggles, another may be thriving.

I began to explore international investing, not as a way to speculate on foreign markets, but as a tool for risk reduction and opportunity capture. I started by allocating a portion of my equity holdings to developed markets like Western Europe and Japan, where companies have strong balance sheets and pay reliable dividends. These markets don’t always move in sync with my home market, which helps smooth out returns. I also added a smaller allocation to emerging markets, such as India, Brazil, and Southeast Asia, where long-term growth potential is high due to expanding middle classes and infrastructure development.

Geographic diversification doesn’t eliminate risk, but it reduces the impact of any one country’s economic problems. For example, if a policy change or political event affects domestic stocks, my international holdings may be less affected or even benefit from capital flows seeking stability elsewhere. Over time, this global spread has contributed to more consistent performance. It has also opened my eyes to companies and industries I might have otherwise overlooked. The key is balance: I don’t try to predict which region will outperform next. Instead, I maintain a steady allocation that reflects the global economy’s size and diversity. This approach keeps me from making emotional shifts based on short-term news and helps me stay focused on long-term growth.

Sector Balance: Avoiding the “Hot Trend” Trap

There’s something exciting about jumping into the latest trend—whether it’s artificial intelligence, electric vehicles, or cryptocurrency-related stocks. I’ve been tempted more than once by the promise of rapid gains. And sometimes, those bets paid off. But more often, they led to disappointment when the trend faded or valuations corrected. I learned the hard way that overconcentration in any single sector can create dangerous blind spots. When one industry dominates your portfolio, your fortunes rise and fall with its performance, regardless of your broader financial goals.

To avoid this trap, I now actively monitor sector exposure across my holdings. I use simple tools provided by my brokerage to see what percentage of my portfolio is allocated to technology, healthcare, financials, consumer goods, energy, and other major sectors. My goal is to stay within reasonable ranges based on the overall market composition. For example, if technology stocks make up 25 percent of a broad market index, I aim to keep my exposure close to that level—not 50 or 60 percent because of a recent rally. This doesn’t mean I avoid high-growth sectors altogether. I still invest in them, but within the context of a balanced portfolio.

Rebalancing is a crucial part of this process. Every few months, I review my allocations and make adjustments if any sector has grown too large due to strong performance. Selling a portion of the winners and reinvesting in underrepresented areas may feel counterintuitive, but it’s a proven way to manage risk and maintain discipline. It also forces me to take profits instead of letting gains turn into losses during a downturn. Over time, this practice has helped me avoid the boom-and-bust cycle that comes from chasing trends. I still pay attention to innovation and economic shifts, but I let them inform my decisions rather than drive them. The result is a portfolio that grows steadily, without being held hostage by the fate of a single industry.

Alternative Assets: The Quiet Stabilizers in My Portfolio

When I first heard about alternative investments, I thought they were only for wealthy investors or financial experts. I imagined complex hedge funds or private equity deals that required deep knowledge and high minimums. But I later discovered that “alternatives” don’t have to be complicated. For everyday investors, they can include accessible options like real estate investment trusts (REITs), commodities, or even infrastructure funds. These assets behave differently from traditional stocks and bonds, which makes them valuable tools for reducing portfolio volatility.

I started small, allocating just 5 to 10 percent of my portfolio to alternatives. I added a REIT fund that invests in commercial and residential properties. Real estate tends to hold value during inflationary periods and provides a steady income stream through dividends. I also included a modest position in a commodities fund, which holds assets like gold, oil, and agricultural products. These don’t produce income like stocks or bonds, but they can act as a hedge when inflation rises or market sentiment turns negative. Because they don’t move in lockstep with equities, they helped cushion my portfolio during periods of stock market stress.

The real benefit of alternatives isn’t that they deliver the highest returns—it’s that they add stability. They don’t eliminate risk, but they change the way my portfolio responds to different economic conditions. For example, when interest rates rise and bond prices fall, commodities or real estate might hold their ground. This diversification across return drivers makes my overall strategy more resilient. I don’t expect alternatives to outperform every year, but I value their role in smoothing out the journey. And because I keep the allocation small, I don’t have to worry about overexposure or complexity. They’re not the star of the show, but they’re the quiet stabilizers that help me stay on course.

Regular Checkups: Making Risk Management a Habit

One of the biggest mistakes I used to make was treating my portfolio like a one-time decision. I would set it up, check it occasionally, and assume it would take care of itself. But markets change. Asset values shift. Sectors grow or shrink. Without attention, even a well-designed portfolio can drift into risky territory. That’s why I now treat investing like financial hygiene—something that requires regular maintenance. I schedule quarterly checkups to review performance, assess risk exposure, and rebalance as needed.

During these reviews, I look at several key metrics. First, I check whether my asset allocation still matches my target. For example, if stocks have had a strong run, they might now represent a larger share of my portfolio than intended, increasing my risk. I also review sector weights, geographic exposure, and the performance of individual holdings. I don’t make changes based on short-term movements, but I do adjust if the data shows a meaningful deviation from my plan. Rebalancing isn’t exciting, and it doesn’t make headlines, but it’s one of the most effective ways to control risk and stay disciplined.

I also use this time to reflect on my goals. Life changes—family needs, career shifts, or unexpected expenses can affect my risk tolerance and time horizon. A checkup isn’t just about numbers; it’s about alignment. Am I still investing for the same reasons? Has my comfort level with risk changed? These questions help me ensure that my portfolio continues to serve my life, not the other way around. Over time, this habit has made me a calmer, more confident investor. I don’t panic when markets drop because I know my strategy is built to handle it. And I don’t get greedy during rallies because I’m focused on balance, not shortcuts.

Building for Stability, Not Just Returns

Looking back, my biggest financial mistake wasn’t losing money—it was misunderstanding risk. I once believed that smart investing meant picking the right stocks or timing the market. Now I know it’s about building a structure that works over time, regardless of what the market does. A smart investment layout isn’t about avoiding risk entirely; it’s about managing it wisely. By diversifying across asset classes, geographies, and sectors, and by treating my portfolio as a living system that needs regular care, I’ve created something that supports my life goals without keeping me awake at night.

This approach won’t make me rich overnight, and it won’t outperform every hot trend. But it has given me something more valuable: confidence. I no longer fear market corrections because I’m prepared for them. I don’t chase every new opportunity because I have a plan. And I’ve learned that protecting wealth is just as important as growing it. In the end, successful investing isn’t about making bold moves—it’s about making consistent, thoughtful ones. By focusing on structure, balance, and discipline, I’ve built a strategy that works for me—through calm and chaos alike.