How I Survived a Job Loss — My Real Cost Control Moves That Actually Worked

Losing my job hit harder than I expected — not just emotionally, but financially. Overnight, every dollar mattered. I had to rethink how I spent, saved, and prioritized. What started as panic turned into a clear plan: strict cost control without sacrificing dignity. I tested strategies, cut hidden expenses, and found what truly helped. This is how I stayed afloat — and what I wish I’d known sooner. It wasn’t about drastic cuts or living in fear, but about regaining control, making thoughtful choices, and protecting my future during one of the most uncertain times of my life. The experience reshaped my relationship with money in ways I never anticipated.

The Moment Everything Changed

The email came on a Tuesday morning — polite, impersonal, and final. I was among several employees being let go due to company restructuring. In that moment, my sense of stability vanished. I had worked at the same organization for nearly nine years. My paycheck wasn’t extravagant, but it was reliable. It covered rent, groceries, insurance, and allowed for the occasional weekend outing or small gift for my children. More importantly, it gave me a sense of security. That security disappeared in less than 30 seconds.

Emotionally, I felt numb at first, then overwhelmed. But I knew I couldn’t afford to stay in shock. My family depended on me, and without immediate income, even basic needs would soon be at risk. The first 48 hours were critical. I resisted the urge to make impulsive decisions — like dipping into retirement savings or maxing out a credit card for peace of mind. Instead, I forced myself to take inventory. I listed every source of potential income, including severance, unemployment benefits, and any freelance opportunities I might pursue. I also mapped out my monthly obligations: rent, utilities, car payment, health insurance, and minimum debt payments.

This clarity helped shift my mindset from panic to problem-solving. I realized that while I couldn’t control the job loss, I could control my response. I accepted that my financial life was now in survival mode — not permanent austerity, but a temporary recalibration. The goal wasn’t comfort; it was sustainability. I needed to stretch my resources as far as possible while actively searching for new work. This period taught me that emotional resilience and financial discipline go hand in hand. Reacting with urgency, not fear, became my guiding principle.

Facing the Numbers: My Emergency Audit

One of the most powerful steps I took was conducting a full financial audit. I gathered every bank statement, credit card bill, and subscription receipt from the past three months. I categorized every expense into essentials — housing, food, utilities, transportation, and health — and non-essentials, which included streaming services, dining out, gym memberships, and online shopping. What I discovered was sobering. I had been leaking money in ways I hadn’t noticed.

For example, I was paying for three different streaming platforms — a habit I justified as ‘family entertainment’ — costing nearly $50 a month. I had an old phone plan with an outdated carrier that charged $85 monthly, even though better options existed. I was also enrolled in a premium grocery delivery service I used only twice a month. These weren’t luxury splurges, but automatic payments I had stopped questioning. Together, they added up to over $200 a month — money I could no longer afford to lose.

I took immediate action. I canceled two streaming services and kept only the one we used most. I switched to a more affordable mobile plan, saving $35 per month. I paused the grocery delivery subscription and committed to in-store shopping with a strict list. I also called my internet provider and negotiated a lower rate by mentioning competitor offers — a simple phone call that saved me $20 a month. These changes didn’t require sacrifice; they required awareness.

The audit also revealed patterns in my spending. I noticed that small, frequent purchases — coffee runs, impulse snacks, last-minute takeout — added up to nearly $150 a month. That was equivalent to a car payment. I began tracking every expense in a simple spreadsheet, which helped me see where money was going and where I could redirect it. The process was humbling, but it gave me power. By confronting the numbers honestly, I freed up over $400 a month — a lifeline that bought me time and reduced anxiety.

Stretching Every Dollar: Daily Survival Tactics

With no paycheck coming in, I had to change how I approached daily life. I shifted from convenience-based spending to intentionality. One of the first changes was in how I handled food. I started meal planning every Sunday, building a weekly menu based on sales flyers from local grocery stores. I bought in bulk when possible — rice, beans, pasta, frozen vegetables — and avoided pre-packaged or ready-made meals, which cost significantly more per serving. I also began cooking larger portions and freezing leftovers for busy days.

I introduced a cash envelope system for variable expenses like groceries, household supplies, and personal items. Each week, I withdrew a set amount of cash and divided it into labeled envelopes. Once the cash was gone, I stopped spending in that category. This simple method eliminated overspending and made me more mindful of choices. It also helped me resist the temptation of credit cards, which could have led to debt I couldn’t repay.

Transportation costs were another area I reevaluated. I used to drive everywhere, even for short trips, without thinking about gas or wear on the vehicle. Now, I combined errands into single outings, used public transit when possible, and walked or biked for local destinations. I also postponed non-essential trips, like weekend getaways or visiting distant relatives, until my financial situation improved.

Entertainment didn’t disappear — it just changed form. Instead of going to movies or restaurants, we had family game nights, visited free community events, or explored local parks. I discovered that joy didn’t require spending. In fact, some of our closest family moments came during this period of constraint. The key was consistency. These weren’t one-time cuts; they were sustained habits that compounded into real savings. Over six months, these daily tactics saved me over $1,800 — money that kept us afloat and gave me breathing room to focus on finding a new job.

The Hidden Costs Nobody Talks About

When people think about unemployment, they focus on big expenses — rent, food, utilities. But there are hidden costs that quietly drain your budget and emotional energy. One of the first I encountered was the cost of job searching. Printing resumes, buying professional portfolio paper, and paying for online certification courses added up quickly. I also needed to update my professional wardrobe — replacing worn blazers, buying new dress shoes, and investing in a modest makeup refresh for interviews. These weren’t luxuries; they were necessary for presenting myself well in a competitive market.

Another unexpected expense was emotional spending. During moments of stress or self-doubt, I caught myself buying small comforts — a scented candle, a book, a piece of chocolate — to regain a sense of control. Individually, these purchases seemed harmless. But over time, they totaled nearly $75 a month. I hadn’t accounted for the psychological toll of unemployment, and how it could lead to impulsive financial decisions.

I also faced fees I hadn’t anticipated. One job application required a background check I had to pay for — $45. Another asked for a professional license renewal that had lapsed, costing $60. These ‘hidden gates’ to employment weren’t common, but when they appeared, they hurt. I began setting aside a small ‘job search fund’ — just $25 a week — to cover these unexpected costs. I also looked for free resources, like public library access to online learning platforms, free resume workshops, and community clothing banks for professional attire.

Perhaps the most invisible cost was the strain on mental health. Worrying about money, feeling isolated, and facing rejection after rejection took a toll. I noticed I was sleeping poorly and feeling irritable. I considered therapy but hesitated because of cost. Eventually, I found a sliding-scale counselor through a local nonprofit — a decision that helped me manage anxiety and stay focused. This experience taught me that financial health and emotional health are deeply connected. Ignoring one harms the other. Planning for these hidden costs — both financial and emotional — became part of my survival strategy.

Protecting Myself: Risk Control in Crisis

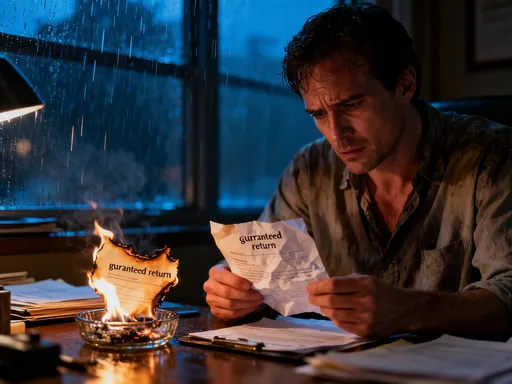

Without a steady income, every financial decision carried higher stakes. I became acutely aware that a single poor choice could have long-term consequences. I saw online ads promising ‘quick money’ — high-return investment schemes, pyramid programs, or ‘easy’ side hustles that required an upfront fee. They were tempting, especially when the bank account was shrinking. But I reminded myself that if something sounds too good to be true, it usually is.

I made a rule: no financial commitment without research and a 48-hour waiting period. This helped me avoid impulse decisions. I also refused to touch my retirement accounts. Withdrawing early would have triggered taxes and penalties, and I knew I’d regret losing that long-term safety net. Instead, I focused on preserving what I had.

I prioritized payments strategically. Housing and utilities came first — losing my home would create even bigger problems. Next was car insurance and registration, which I needed for job interviews. I contacted creditors and explained my situation. To my surprise, many were willing to offer temporary hardship plans — deferred payments, reduced interest, or waived fees. I kept records of every conversation and agreement in writing.

I also protected my credit score. I avoided opening new credit lines or taking out payday loans, which come with exorbitant interest rates. I paid at least the minimum on all debts to avoid late marks. I monitored my credit report monthly through a free service to ensure accuracy. I knew that a strong credit score would be essential when I eventually secured a new job and needed to rebuild financially. This focus on risk control wasn’t about playing it safe — it was about ensuring I wouldn’t emerge from unemployment in deeper financial trouble.

Finding Light: Small Wins That Kept Me Going

Unemployment can feel like walking through fog — no clear path, no immediate rewards. But I learned to celebrate small victories. One week, I managed to stay under my grocery budget by $30. I treated it like a win. Another day, I successfully negotiated a lower rate on my car insurance by shopping around and calling to ask for a loyalty discount. These weren’t life-changing moments, but they reminded me I still had agency.

I started tracking progress in a journal — not just expenses, but accomplishments. ‘Applied to five jobs today.’ ‘Cooked all meals at home this week.’ ‘Had a productive call with a career coach.’ Writing them down made them real. It shifted my focus from what I had lost to what I was still capable of doing.

One of the most meaningful wins came when my teenager noticed our tighter budget and asked how she could help. She offered to skip her monthly clothing allowance and instead earn money by tutoring younger students. Her initiative filled me with pride and reinforced that financial discipline isn’t about shame — it’s about responsibility and care for one another.

These small wins built momentum. They didn’t shorten the job search, but they strengthened my resolve. They reminded me that control, even in small doses, reduces fear. Each positive choice reinforced the next. Over time, I developed a rhythm — structure in the chaos. That sense of forward motion, however slow, was essential to maintaining hope.

Rebuilding: What I Carry Forward

When I finally accepted a new position — a role that aligned with my skills and values — I didn’t rush back to my old spending habits. The experience had changed me. I now view money not as something to spend, but as a tool for security and freedom. I kept my lean budget for the first three months of my new job, directing the surplus into an emergency fund. I’ve since rebuilt it to cover eight months of essential expenses — far beyond the standard three-to-six-month recommendation.

I also maintain the habits I developed during unemployment. I still meal plan, use cash envelopes for discretionary spending, and review subscriptions quarterly. I negotiate bills annually and compare insurance rates every year. I’ve automated savings so that a portion of every paycheck goes directly into long-term goals. These aren’t restrictions — they’re choices that reflect greater awareness.

Most importantly, I’ve learned the value of preparation. I now see financial resilience as a form of self-respect. It’s not about living in fear of job loss, but about honoring the effort it takes to build a stable life. I teach my children about budgeting, saving, and the difference between needs and wants. I share what I’ve learned with friends who’ve faced similar challenges, not as an expert, but as someone who’s been through it.

Job loss was one of the hardest experiences of my life, but it also became one of the most transformative. It stripped away complacency and revealed what truly matters. I emerged not just with a new job, but with a new mindset — one rooted in control, clarity, and long-term thinking. The crisis didn’t break me; it rebuilt me. And for that, I am unexpectedly grateful.